By Grace McGettigan

17th Feb 2020

17th Feb 2020

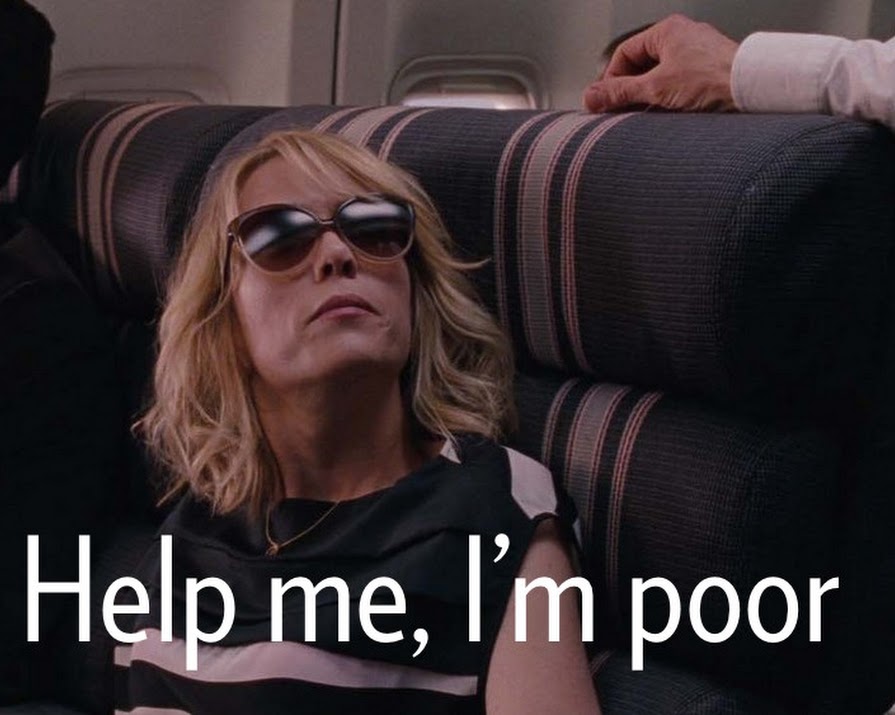

Save money - money challenge

Whether you’re saving up for a dream holiday, a home renovation or just a rainy day – here are 30 easy ways to save money in 2020

Is it just us, or does payday seem like ages away? With a holiday to book, two weddings coming up, and a stream of birthdays on the horizon (oh, and rent, of course) – we need to save money (and fast).

With that in mind, Team IMAGE has come up with a 30-day money-saving challenge, consisting of 30 easy ways to save money for the year ahead.

Save money in just 30 days

1. Set financial goals. Figure out exactly what you’re saving for, how much you want to save, and when you’d like to have it saved by. This will keep you motivated and on-track.

2. Discover your ‘money script’. Financial psychologist Brad Klontz found that people’s attitudes towards money (or their ‘money scripts’) are learned in childhood and often passed down from our parents. There are four types of money script, and once you determine yours, you’ll understand your spending habits better.

3. Do a one-day spending fast. Can you go a whole day without spending a penny? Walk or cycle to work, rather than pay for public transport or parking, and say no to eating out and online shopping. If all goes well, do it again another day – or even once a week.

4. Budget with cash envelopes. Decide how much money you’ll need for the week (or month), withdraw it from the ATM and pop it in an envelope. That’s your money for the week – be strict with yourself and avoid returning to the ATM or tapping your debit card.

5. Request your credit history. This will allow you to see how ‘healthy’ your financial accounts are, as well as highlight your track record in repaying loans.

6. Cancel unused subscriptions. Whether it’s Audible, Hayu, Netflix or NowTV – if you don’t use it, don’t pay for it.

7. Start a €2 jar. Every time you receive a €2 coin as change, place it into a jar (or an empty Pringles tin will do the job too). At the end of the month, or at the end of the year, open it up to see how much you’ve saved.

8. Batch-cook for the week ahead. Avoid the temptation to order takeaway or eat out by preparing your meals in advance.

9. Ask for a raise. Make a case for why you deserve a raise – your contributions to the company to-date, why you’re a valued employee and your length of service. The worst they can say is no.

10. Supermarket swap. Are your usual grocery items available elsewhere for less? Can you get the essentials cheaper from your local shop? Shop around, swap around and see your savings increase.

11. Be carpark-savvy. Choose a shopping centre with free parking, rather than paid parking. It all adds up. Better yet – get the bus to save on fuel.

12. Get a Leap card. Fares on public transport are more expensive when you pay by cash or coin. By using a Leap card, you can save up to 31% on transport costs. What’s more, the Leap card caps your daily and weekly spend so you never splash out more than you have to.

13. Use up food in the freezer / canned goods in the cupboard. Why buy extra food when there’s already plenty at home?

14. Switch energy/ internet/ phone provider. The adverts on radio and TV are always boasting about great savings. Take the companies up on their offers to cut back on utility expenses.

15. Sign up to Revolut. The app’s ‘vault’ feature allows you to save loose change from every card transaction. It’s a handy way to put money aside without even realising.

16. Make a packed lunch every day. Mix it up with different dishes and recipes so that you won’t get bored.

17. Start composting. Your brown bin is much cheaper to dispose of than your grey/black bin. Fill it up with food scraps so that your expensive bin doesn’t fill up so often.

18. Leave your debit card at home. You can’t spend money if you don’t have any with you, right?

19. Make money while making space. Sell unwanted clothes and accessories on Depop, eBay or in consignment stores.

20. Visit your bank and ask about alternative account types. Most banks offer various types of savings and current accounts, with some having much lower monthly fees than others. Find an account type with fees to suit your budget.

21. Suss out free activities in your area. This is particularly good if you have kids. Save on play centres by visiting the local playground instead.

22. Join your local library. Borrow books rather than purchasing them.

23. Be coupon-savvy. Keep an eye out for money-off vouchers in the newspaper, and hang onto money-back vouchers on the back of your receipts.

24. Use your rewards cards. Store loyalty is often rewarded with discounts and pay-with-your-points schemes. Not only do supermarkets offer this, but so too do pharmacies and fashion and beauty retailers.

25. Set up a direct debit at the credit union. Make life easy and convenient for yourself by setting up a direct debit with your credit union. Choose an amount that suits your budget to go into your savings every week – whether it’s €10 or €100, it all adds up.

26. Buy generic goods, rather than branded labels. Whether it’s your morning cereal, washing powder or a packet of paracetamol – buying generic products can save you a lot of money.

27. Make smart savings at home. Turn down your heating (and don’t heat rooms that aren’t occupied). According to Electric Ireland, you can save up to 3% off your energy bill by turning down the thermostat by just one degree.

28. Use a Keep Cup. Many coffee shops reward customers with a discount if they opt for a reusable cup over a disposable one. Better yet, make coffee at home and avoid buying out altogether.

29. Get an item repaired rather than buy a new one. Have you got a great coat with a busted zip? Or an old, worn pair of boots? Visit your local alterations shop or cobbler to give them a new lease of life. The same goes for furniture and electrical appliances – simply search online for your nearest repair shop.

30. Use, wash and re-use a dishcloth rather than forking out on paper towels. It’s better for your wallet and the environment.

Photo: Bridesmaids, Apatow Productions and Relativity Media

Read more: ‘I paid off €15,027 of debt in one year. This is how I did it’

Read more: Meet the women who started businesses in their 40s

Read more: 20 Dolly Parton quotes that prove she’s the wisest woman in the room